How to apply for the Wells Fargo Active Cash Card

Applying for the Wells Fargo Active Cash Card is a process that many consumers pursue because of the benefits associated with it. Next, we will cover the steps and requirements necessary to acquire this card efficiently, allowing you to enjoy the advantages it offers.

How to apply for Wells Fargo Active Cash Card

Applying for the Wells Fargo Active Cash Card is a straightforward procedure, but it is important to be aware of the requirements and steps involved. Here is a step by step guide:

- Basic Requirements: First of all, make sure you meet the minimum requirements set forth by Wells Fargo, such as minimum age and income requirements.

- Necessary Documentation: Have documents such as personal identification, proof of income and proof of residence.

- Website Access: Visit the official Wells Fargo website and look for the credit card section. Select the Active Cash card.

- Request Form: Complete the online form with all the requested information. Make sure you provide accurate and up-to-date data to avoid delays or rejections.

- Submission and Analysis: After submitting the form, the bank will perform a credit analysis. This process may take a few days, and you will receive a response via email or phone.

- Bank Response: If approved, you will receive additional information on next steps and when to expect to receive your card. In case of rejection, the bank usually provides a reason for the decision.

- Activation: After receiving the card at your home, follow the instructions provided to activate it, usually over the phone or through the Wells Fargo website/app.

Remember to read all terms and conditions associated with the card before finalizing the application. This way, you will be aware of all fees, benefits and liabilities associated with Wells Fargo Active Cash.

How to apply for a duplicate of the card?

Whether due to loss, theft or damage, requesting a duplicate of your Wells Fargo Active Cash Card is a process designed to be simple and efficient. Follow the steps below to ensure a quick replacement:

Contact the Bank Immediately

In the event of loss or theft, notify Wells Fargo as soon as possible. This minimizes the risk of card misuse.

Communication channels

You can request the second way:

- Phone: Call the Wells Fargo Customer Service Hotline.

- Application: Access the Wells Fargo mobile application, go to the card management section and select the option to request a replacement.

- Website: Log into your account on the official Wells Fargo website, go to the card management area and follow the instructions to request a duplicate.

Identity Verification

Regardless of the chosen channel, the bank may request additional information to verify your identity and ensure the security of the transaction.

Additional Information

Let your bank know if you believe your card has been stolen or if there are unauthorized transactions on your account. This helps the bank monitor and protect your account from fraudulent activity.

Waiting time

After requesting the duplicate, the bank will send the new card to the address registered in your account. Delivery time may vary, but it usually takes between 7-10 business days.

Activation

When you receive the new card, follow the attached instructions to activate it. This often involves calling a specific number or activating through the bank’s website or app.

Destroy the Old Card

If you find the original card after applying for the duplicate, destroy it to ensure it is not misused.

Remember to always keep your contact details up to date with the bank. That way, in situations like this, Wells Fargo can efficiently communicate with you and ensure your card is delivered correctly.

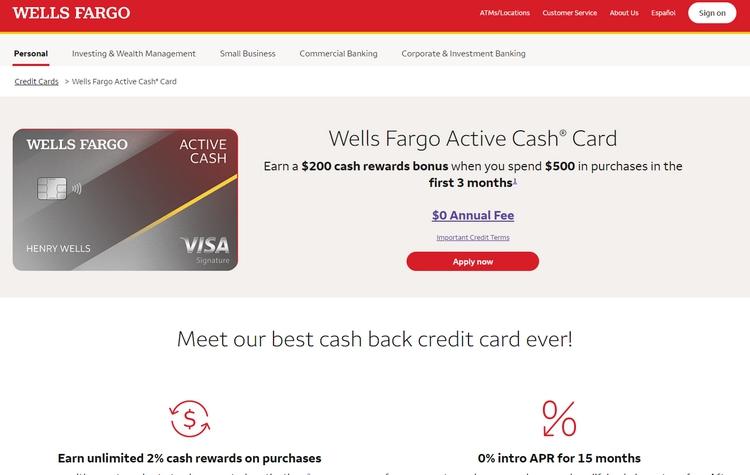

Benefits of the Wells Fargo Active Cash Card

Among the main benefits provided by the Wells Fargo Active Cash credit card we can mention:

Cash Rewards: The card offers a percentage back on all purchases, allowing users to accumulate cash rewards.

No Annual Fee: There is no annual fee associated with the card, which means savings for the cardholder.

Purchase Protection: In case of damage or theft of items purchased with the card, there may be coverage that offers a refund.

Advanced Security: The card has fraud protection technologies, ensuring safe transactions.

Exclusive Offers: Cardholders have access to promotions and special offers at partner establishments.

Redemption Flexibility: Accumulated rewards can be redeemed in a variety of ways, including invoice credit or account deposit.

These are the core benefits of the Wells Fargo Active Cash card, making it an attractive choice in the credit card market.

Telephone

The phone numbers to resolve any issue related to your Wells Fargo credit or debit card are as follows:

Debit Cards

Request a new or replacement debit card, report a lost/stolen debit card, or for debit card questions

- 1-800-869-3557

24 hours a day, 7 days a week

Credit Cards

- 1-800-642-4720

International Collect Calls

- 1-925-825-7600

24 hours a day, 7 days a week