How to Apply for the Capital One Venture Rewards Credit Card

Navigating the vast world of credit card rewards can be overwhelming, but if you’re on the hunt for exceptional travel perks, you might want to apply for Capital One Venture Rewards. This card has gained notable traction among globetrotters and casual spenders alike. Its unique selling points have sparked interest, making it a front-runner in the competitive realm of travel credit cards.

In the age of digital banking, consumers have become savvy about where and how they spend. They’re searching for cards that not only offer tangible benefits, but also align with their lifestyle and spending habits. Capital One Venture Rewards promises exactly that, providing flexibility and generous reward rates.

Still wondering if this card is the right fit for you? Stick around as we dive deeper into its features, pros, cons, and how it stands out in the bustling market of credit rewards. Equip yourself with the knowledge to make an informed decision and potentially unlock a world of travel opportunities.

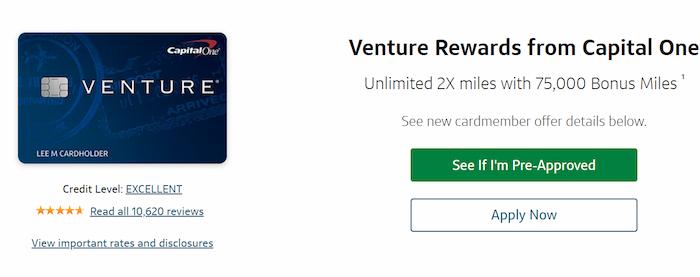

How to Apply for the Capital One Venture Rewards Card?

Whether you’re an avid traveler or simply looking for a credit card with unmatched benefits, the Capital One Venture Rewards Card might be the right choice for you. Ready to get started? Here’s a straightforward step-by-step guide to get you on your way:

- Visit the Official Website: Navigate to the Capital One official website.

- Search for the Card: In the credit cards section, locate the “Venture Rewards” card.

- Click “Apply Now”: This button will redirect you to the application page.

- Provide Personal Details: Enter essential details like your name, address, date of birth, and social security number.

- Input Financial Information: Share your employment status, total annual income, and monthly rent or mortgage.

- Review & Agree to Terms: Before proceeding, ensure you’ve read and understood the card’s terms and conditions.

- Submit Application: Once satisfied, click on the “Submit” button.

- Wait for Approval: Typically, you’ll receive an instant decision, but in some cases, it may take a few days.

Remember, while the application process is straightforward, approval is based on creditworthiness. Always review the card’s requirements before applying to increase your chances of approval.

How do I request a second copy of the card?

If you ever find yourself in need of a second copy of your Capital One Venture Rewards Card, perhaps due to misplacement or wear and tear, the process is straightforward. Begin by contacting Capital One’s customer service. This can be done either through their official website’s chat feature or by calling the number on the back of your card.

Once connected, inform the representative of your need for a duplicate card. They’ll verify your identity with a few security questions and then proceed to process your request. At this juncture, it’s essential to ensure that your current mailing address is updated in their system, as this is where the card will be dispatched.

Benefits of the Capital One Venture Rewards Card

Curious about what’s in store? Let’s unravel the enticing suite of benefits that await cardholders.

- Unlimited 2X miles per dollar on every purchase

- Up to 100,000 bonus miles as a sign-up offer

- No foreign transaction fees

- Global Entry or TSA Pre✓® fee credit

- Transfer miles to multiple travel loyalty programs

- Extended warranty on purchases

- 24/7 travel assistance services

- No expiration on miles as long as the account is open

- Redeem miles for flights, hotels, or even as a statement credit for travel purchases

- Auto rental collision damage waiver

- Roadside assistance

- Travel accident insurance

- Zero fraud liability for unauthorized use

- Access to premium experiences and events

- Flexible redemption options, including for non-travel related expenses.

Card telephone

In today’s fast-paced world, quick and reliable communication methods are paramount. Whether it’s to report a lost card, inquire about benefits, or seek clarity on transactions, having a direct line to your card provider ensures peace of mind and swift resolutions. The Capital One Venture Rewards Card, understanding the essence of this connection, provides a robust suite of communication channels for cardholders.

Principal Communication Channels for Capital One Venture Rewards:

- Customer Service Telephone Line: 1-800-CAPITAL (227-4825)

- Secure Messaging Portal: Accessible via the Capital One online account, this allows cardholders to communicate directly with support agents.

- Mobile App Support: Through the Capital One mobile app, users can get instant support and manage their card details.

- Email Notifications: Important alerts, promotions, and card updates are sent directly to the registered email address.

- Mailing Address: For traditional mail correspondence, Capital One provides a physical address for card services.

- Social Media Channels: Platforms such as Twitter and Facebook often have dedicated support teams to assist with public queries and direct messages.

By offering diverse communication avenues, Capital One Venture Rewards ensures that cardholders are always a click or call away from assistance, underscoring their commitment to impeccable customer service.