Benefits of the Wells Fargo Reflect: Find out everything to apply

When hearing the term Wells Fargo Reflect, one may instantly think of innovation and evolution in the banking industry. This new offering from the financial giant represents more than just a service; is a window into the future of personal finance. In the constantly digitalizing world, adapting to new systems and platforms is more than necessary; is crucial.

Wells Fargo, with its long history and global recognition, shows, once again, that it is at the forefront of banking solutions. Understanding Reflect is not just learning about a new service, but understanding the vision of a bank that continually seeks to improve the customer experience.

And now, you have the chance to dive into this universe. Do you want to understand how Wells Fargo Reflect can revolutionize your relationship with money and financial management? Stay with us and discover the potential and benefits that this innovation can bring to your life.

Wells Fargo Reflect Benefits

Wells Fargo Reflect is not just another offering in the vast world of banking services; It is a promise of a more integrated and efficient future. But what are the tangible benefits it can bring to its users? Let’s explore:

- Modernization of financial management with cutting-edge technology.

- Greater control and visibility over transactions and balances.

- Personalized service, adapted to the client’s individual needs.

- Fast and secure access through multiple digital platforms.

- Advanced tools for financial planning and analysis.

- Cost reduction through integrated operational efficiencies.

- Guarantee of security and privacy when handling information.

- Flexible options for investment and wealth management.

- Services adaptable to different profiles and financial objectives.

- Continuous support and regular updates to keep you ahead in the financial world.

Does the Wells Fargo Reflect card accept negatives?

Wells Fargo, like most major banks, performs credit checks before approving a new credit card application. This means that, in general, individuals with negative histories or low credit scores may face difficulties in approval.

Card flag

The Wells Fargo Reflect Credit Card is a credit card with wide national and international acceptance. It is issued under the Visa brand, which is one of the most accepted credit card brands in the world.

What is the annual fee for Wells Fargo Reflect?

The Wells Fargo Reflect Card has no annual fee. This makes it a good option for cardholders who are looking for a no-frills credit card with no ongoing costs. However, it is important to note that the Wells Fargo Reflect Card does have other fees, such as a balance transfer fee and a foreign transaction fee. Be sure to read the terms and conditions carefully before applying for this card so that you are aware of all of the potential fees.

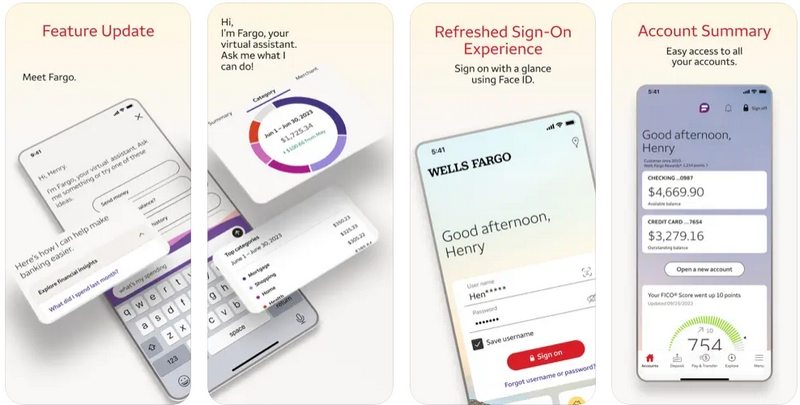

Wells Fargo Reflect app

The app provides a clear and concise view of transactions, enabling real-time monitoring of spending and helping users stay within their budgets. Furthermore, the ability to make payments, transfers and even set up alerts makes financial management practical and hassle-free.

Security, without a doubt, is a primary concern. The Wells Fargo Reflect app incorporates cutting-edge technologies to ensure user data is protected against any cyber threat. Two-factor authentication, facial and fingerprint recognition are just some of the features that raise the bar for security.

Phone

In an increasingly connected world, a bank’s ability to communicate effectively with its customers is vital. Wells Fargo Reflect, being one of the institution’s most recent innovations, clearly demonstrates this need through its various means of communication. Here are the main ones:

- Telephone: 1-800-955-2265.

- Mobile App: Through the app, customers can access live chat, send messages and receive important notifications related to their account.

- Website: On the official website, in addition to a login area for account management, there is a Frequently Asked Questions (FAQ) section and a space for direct contact.

- Email: For non-urgent inquiries or documentation, email is a convenient option. Wells Fargo frequently sends updates and important information via email.

- Social Media: Wells Fargo is present on several social media platforms, such as Twitter, Facebook and LinkedIn, where customers can get information, news and even interact with bank representatives.

- In-person service: For those who prefer more direct contact, Wells Fargo branches are open for customer service, with experts ready to help.